QuickBooks is not just an accounting software—it is the backbone of over 7 million businesses worldwide.

Whether you are a freelancer, a retail shop owner, or running a growing team, QuickBooks can help you track every dollar, automate the boring stuff, and keep your accountant happy.

But with so many features, plans, and add-ons, it is easy to get lost.

In this guide, I will explain everything about Quickbooks Software so that you can decide whether it is good fit for your small business or not.

What is QuickBooks Software?

QuickBooks is accounting software built for businesses of all sizes. It helps you send invoices, track expenses, run payroll, and generate reports. You can use it on your computer, phone, or tablet.

QuickBooks is trusted and the go-to choice for small business owners, start-ups, and pros who want to keep things simple but powerful.

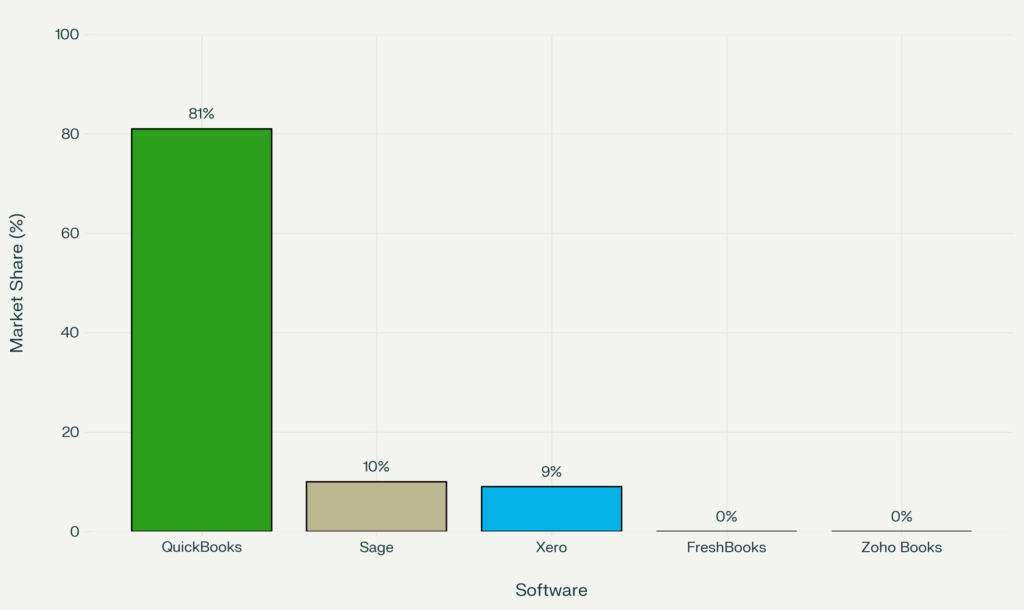

As per the latest data, Quickbooks is the most used accounting software in the USA. Check below graph:

Who Should Use QuickBooks?

- Freelancers & Solopreneurs: Track income, send invoices, and keep taxes simple.

- Small Businesses: Manage payroll, inventory, and cash flow in one place.

- Growing Teams: Collaborate with your accountant, bookkeeper, or staff.

- Nonprofits: Track grants, donations, and run custom reports for compliance.

If you’re tired of spreadsheets or want to avoid tax season panic, QuickBooks is for you.

QuickBooks Online vs. Desktop: Which Fits You?

| Feature | QuickBooks Online | QuickBooks Desktop |

| Access | Cloud (any device) | Installed (Windows/Mac) |

| Updates | Automatic | Manual |

| Best For | Remote teams, startups | Inventory-heavy, advanced reporting |

| Price | $30–$200/month | $349.99/year (one-time fee) |

| Integrations | 750+ apps | 200+ apps |

Quick tip: If you want to work from anywhere or need to share access, go with Online. If you need advanced inventory or don’t want a monthly bill, Desktop might be your pick.

Core Features of QuickBooks Accounting Software

1. Invoicing & Payments

QuickBooks makes invoicing simple and flexible. You can create professional invoices in under two minutes, customize them with your logo, and add payment terms that fit your business.

The system supports multiple currencies, which is a lifesaver for companies working with international clients.

You can accept payments through credit cards, ACH bank transfers, and PayPal, all from the same invoice. This means your customers have more ways to pay, and you get your money faster—often within one business day for card payments.

Recurring invoices are easy to set up for subscription services or regular clients. QuickBooks automatically sends these on your schedule, so you never miss a billing cycle.

You can also track invoice status in real time. See when a client opens your invoice, and send reminders with one click if payment is late. This helps you keep cash flow steady without awkward follow-ups.

2. Expense Tracking

QuickBooks connects to over 20,000 banks and credit card providers, so your transactions import automatically. This means you don’t have to type in every expense or worry about missing a receipt.

The software uses smart rules to auto-categorize expenses based on your past activity. For example, if you always tag Uber rides as “Travel,” QuickBooks will start doing it for you.

You can snap a photo of any receipt with your phone, and QuickBooks matches it to the right transaction. This is especially helpful at tax time, since you’ll have a digital record for every deduction.

You can also split expenses across categories or projects, making it easy to track spending for different clients or jobs. This level of detail helps you spot trends, cut unnecessary costs, and stay on budget.

3. Payroll

QuickBooks Payroll is built for both employees and contractors. You can run payroll in just a few clicks, and the system calculates federal, state, and local taxes automatically.

It files payroll taxes and year-end forms (like W-2s and 1099s) for you, so you don’t have to worry about missing deadlines or making costly mistakes.

Direct deposit is included, and employees can access their pay stubs and tax forms online.

QuickBooks supports compliance in all 50 states, including overtime, sick leave, and new hire reporting.

You can also manage benefits, like health insurance and retirement plans, right from your dashboard. This makes it easier to attract and keep top talent, even if you’re a small business.

4. Reporting

QuickBooks offers over 50 built-in reports, including Profit & Loss, Balance Sheet, and Cash Flow statements. These reports update in real time, so you always know where your business stands.

You can customize dashboards to show the metrics that matter most to you—like sales by product, expenses by vendor, or outstanding invoices.

Reports can be filtered by date, customer, project, or location, giving you granular insights for better decision-making.

Export any report to Excel or PDF with one click, making it easy to share with your accountant or business partners.

You can also schedule reports to run automatically and arrive in your inbox, so you never miss a key update.

5. Automation

QuickBooks automates repetitive tasks to save you hours every month.

You can set up recurring transactions for bills, rent, or subscriptions, so you never forget a payment.

Bank rules let you sort and tag expenses automatically, reducing manual entry and errors.

The software calculates sales tax based on your location and the latest tax rates, so you always collect and remit the right amount.

You can also automate reminders for overdue invoices, helping you get paid faster without chasing clients.

For businesses with inventory, QuickBooks can automate stock level alerts and reorder points, so you never run out of your best sellers.

6. Mobile App

The QuickBooks mobile app brings your accounting to your pocket.

You can create and send invoices from anywhere—at a client’s office, in your car, or even at the airport.

Track mileage automatically using your phone’s GPS, which is perfect for maximizing your tax deductions.

Snap photos of receipts and attach them to expenses on the spot, so you never lose a deduction.

The app also lets you check your cash flow, review reports, and manage contacts, all in real time.

Push notifications alert you to overdue invoices, low inventory, or bank connection issues, so you can act fast and keep your business running smoothly.

Each feature in QuickBooks software is designed to save you time, reduce errors, and give you a clear view of your business finances.

Whether you’re just starting out or managing a growing team, these tools help you stay organized, compliant, and ready for whatever comes next.

Hidden Gem: Use “Projects” to track profitability by job or client—perfect for agencies and contractors.

QuickBooks Pricing: Plans, Add-Ons, and Real Costs

| Plan | Cost/Month | Users | Key Features | Add-Ons (Extra Cost) |

| Simple Start | $30 | 1 | Invoicing, expense tracking | Payroll ($45+), Time ($20+) |

| Essentials | $55 | 3 | Bill management, time tracking | Payroll, Advanced Reporting |

| Plus | $90 | 5 | Inventory, project tracking | Payroll, Advanced Reporting |

| Advanced | $200 | 25 | Custom permissions, analytics | Dedicated support |

Add-Ons:

- Payroll: $45–$125/month

- Time Tracking: $20/month

- Advanced Reporting: $50/month

- Industry-specific tools: Varies

Discounts: Nonprofits, schools, and some startups can get up to 50% off.

How to Set Up QuickBooks (Step-by-Step)

Setting up QuickBooks the right way saves you hours down the road.

Here’s a detailed process that covers every important step—so you can get started with this best accounting software effortlessly:

Step 1 – Pick Your Plan

Start by choosing the QuickBooks plan that matches your business needs.

- Simple Start is best for freelancers or solo business owners who need basic invoicing and expense tracking.

- Essentials adds bill management and time tracking, making it a good fit for service businesses with a small team.

- Plus includes inventory tracking and project profitability, ideal for retailers or contractors.

- Advanced is designed for larger businesses needing custom permissions, analytics, and up to 25 users.

If you’re unsure, use the free 30-day trial to test features before you commit.

Compare the plan features and prices side by side on the QuickBooks website to make an informed choice.

Step 2 – Create Your Account

Sign up using your business email address.

- This keeps your business and personal finances separate.

- Use a strong password and enable two-factor authentication for added security.

- Fill in your business name, address, and contact details exactly as they appear on your legal documents and tax forms.

- Choose your business type (sole proprietor, LLC, corporation, etc.) so QuickBooks can tailor your setup.

Step 3 – Import Data

Bring your existing data into QuickBooks to save time and reduce manual entry.

- Customers and Vendors: Download your lists from your old system or Excel, then use QuickBooks’ import tool.

- Products and Services: Import your inventory or service list, including item names, prices, and quantities.

- Chart of Accounts: If you’re switching from another accounting system, export your chart of accounts and upload it to QuickBooks.

Check your data for duplicates or errors before importing. QuickBooks will flag any issues and let you fix them on the spot.

Step 4 – Connect Your Bank

Link your business bank accounts and credit cards for automatic transaction syncing.

- Go to the Banking tab and search for your bank.

- Enter your online banking credentials securely.

- Select which accounts to connect (checking, savings, credit cards, PayPal, etc.).

- QuickBooks will pull up to 90 days of past transactions, so you can start with a complete record.

Review the imported transactions and match them to your existing records. This step helps you catch any missing or duplicate entries right away.

Step 5 – Customize Your Chart of Accounts

The chart of accounts is the backbone of your bookkeeping.

- Review the default categories QuickBooks provides (like “Office Supplies,” “Sales,” “Utilities”).

- Add, rename, or delete accounts to match your business needs. For example, if you run a landscaping business, you might add “Equipment Rental” or “Plant Purchases.”

- Assign account numbers if you want more control or if your accountant requests it.

A well-organized chart of accounts makes reporting and tax time much easier.

Step 6 – Set Up Invoicing

Personalize your invoices to look professional and get paid faster.

- Upload your business logo and choose a color scheme that matches your brand.

- Set your default payment terms (like “Net 15” or “Due on Receipt”).

- Add sales tax rates for your state or region, so invoices calculate tax automatically.

- Enable online payments so customers can pay by credit card, ACH, or PayPal directly from the invoice.

Test your invoice by sending one to yourself. Check for typos, formatting issues, and make sure the payment link works.

Step 7 – Invite Your Accountant

Give your accountant or bookkeeper direct access to your QuickBooks account.

- Go to the “Manage Users” section and invite them by email.

- Assign them the “Accountant” role, which gives them access to all the financial data they need—without letting them change sensitive settings.

- Your accountant can now review your books, make adjustments, and run reports anytime, without you having to send files back and forth.

This step saves you time and helps prevent errors, especially at tax time.

Pro Tip: Use the Free Setup Checklist

QuickBooks offers a free setup checklist in their resource center. Print it out or keep it open in another tab as you work through these steps.

The checklist covers every detail, from setting up sales tax to connecting payroll, so you don’t miss anything important.

QuickBooks Integrations and Add-Ons: Up-to-Date Overview

QuickBooks connects with over 750 apps, making it a powerhouse for automating and streamlining your business.

Here’s a detailed look at the most popular integration categories, what they do, and how they add value:

E-commerce Integrations

- Shopify: Syncs orders, inventory, taxes, refunds, and payouts in real time. With tools like Webgility, you can match deposits and sales automatically, keep stock levels updated across all channels, and get AI-powered insights into revenue and expenses. Works with QuickBooks Online and Desktop, plus other marketplaces like Amazon, eBay, Walmart, and Etsy.

- WooCommerce: The QuickBooks Connector for WooCommerce lets you sync orders, customer details, products, and payment info directly to QuickBooks. It supports real-time, two-way inventory management, so your stock levels stay accurate. You can map orders as sales receipts, invoices, or credit memos, and sync customer and product data, including SKUs and prices.

- Amazon: Connects your Amazon seller account to QuickBooks for automatic syncing of sales, fees, and inventory. This reduces manual entry and helps with accurate reconciliation across multiple sales channels.

Payment Processors

- Stripe, PayPal, Square: Using apps like PayTraQer, you can sync all your payment data—including invoices, payments, refunds, deposits, and processor fees—directly into QuickBooks Online. This automation covers income, expenses, and payouts, making reconciliation fast and eliminating manual work. All transactions are matched and categorized for you.

CRM Integrations

- Salesforce: Connects your sales and financial data, so you can track customer transactions, invoices, and payments in one place. This helps sales and finance teams stay aligned and improves customer management.

- HubSpot: Two-way sync between QuickBooks and HubSpot CRM means any updates in one system show up in the other. This integration streamlines processes, reduces manual entry, and gives you a complete view of customer financials and interactions. It’s especially useful for aligning sales, marketing, and finance teams, and for automating workflows like invoice creation or payment reminders.

Inventory Management

- Fishbowl: Fishbowl’s integration with QuickBooks lets you manage inventory and order fulfillment outside of QuickBooks, then syncs the financial data back in. You can map accounts, automate inventory updates, and consolidate reporting. Fishbowl becomes your inventory “source of truth,” while QuickBooks handles the accounting side. Note: Sales and purchase orders need to be managed carefully during setup for smooth syncing.

- SOS Inventory: Adds advanced inventory, order management, and manufacturing features to QuickBooks. Great for businesses with complex inventory needs.

Time Tracking

- TSheets (now QuickBooks Time): Employees can clock in/out from anywhere, and their hours sync directly to QuickBooks for payroll and job costing.

- ClockShark: Designed for field service and construction teams, ClockShark syncs jobs, customers, service items, and employees with QuickBooks. It offers two-way sync, so changes in either system are reflected in both. You can approve timesheets, run payroll, and generate job reports with just a few clicks. The integration is easy to set up and helps cut payroll time in half while reducing errors.

Analytics and Reporting

- Fathom: Fathom connects to QuickBooks and imports your financial data for advanced analysis, visual reporting, and forecasting. It updates automatically every 24 hours, supports multi-company consolidation, and lets you create custom report templates. Fathom is ideal for businesses that want deeper insights, cash flow forecasting, and KPI tracking. You can automate report creation and delivery, saving time and improving decision-making.

- Microsoft Power BI: Pulls QuickBooks data into interactive dashboards for custom analytics and business intelligence.

How These Integrations Help Your Business?

- Save time: Automate data entry, reconciliation, and reporting.

- Reduce errors: Two-way sync keeps information consistent across platforms.

- Get paid faster: Streamline invoicing, payments, and follow-ups.

- Make smarter decisions: Real-time analytics and consolidated data give you a clear financial picture.

- Scale easily: Add new sales channels, payment methods, or team members without extra manual work.

Pro Tip:

Start with the integrations that solve your biggest pain points—like e-commerce syncing or payroll automation.

As your business grows, you can add more apps to cover inventory, analytics, or CRM needs.

Most integrations are easy to set up and come with support if you get stuck.

With the right QuickBooks integrations and add-ons, you can run your business smarter, not harder.

Industry-Specific QuickBooks Solutions

QuickBooks adapts to the unique needs of different industries by offering specialized features and workflows.

Here’s how QuickBooks supports retail, construction, nonprofits, and professional services—each with practical examples and actionable details.

Retail: Inventory Tracking, Barcode Scanning, Sales Tax Automation

QuickBooks helps retail businesses manage inventory, sales, and taxes with precision.

- Inventory Tracking: Monitor stock levels in real time, set reorder points, and receive alerts when items run low. QuickBooks automatically updates inventory counts as you make sales or receive new stock, reducing manual errors and out-of-stock situations.

- Barcode Scanning: Integrate barcode scanners to speed up checkout and inventory counts. This feature helps retailers process sales faster and keep inventory records accurate.

- Sales Tax Automation: QuickBooks calculates sales tax based on your store’s location and the latest tax rates. It applies the correct tax to each sale, even if you sell in multiple states, and generates detailed sales tax reports for easy filing.

- Example: A clothing store uses QuickBooks to track 2,000+ SKUs, automatically update inventory after each sale, and generate monthly sales tax reports for state compliance.

Construction: Job Costing, Progress Invoicing, Contractor Payments

QuickBooks gives construction companies tools to track project costs, bill clients, and pay subcontractors.

- Job Costing: Assign expenses, labor, and materials to specific jobs or projects. QuickBooks tracks actual costs versus estimates, helping you spot overruns early and keep projects profitable.

- Progress Invoicing: Bill clients in phases as work is completed. QuickBooks lets you create invoices for a percentage of the total project or for specific milestones, making cash flow more predictable.

- Contractor Payments: Manage payments to subcontractors, generate 1099 forms, and track compliance with tax regulations.

- Example: A home builder uses QuickBooks to track costs for each house, invoice clients after each construction phase, and pay subcontractors with direct deposit.

Nonprofits: Fund Tracking, Donation Receipts, Grant Management

QuickBooks supports nonprofits with features designed for transparency and compliance.

- Fund Tracking: Use class and location tracking to separate funds by program, grant, or donor. This makes it easy to report on how money is used and meet grant requirements.

- Donation Receipts: Automatically generate and email donation receipts with all required IRS information, saving time during fundraising campaigns.

- Grant Management: Track grant income and expenses, set budgets for each grant, and run reports to show funders exactly how their money was spent.

- Example: A local animal shelter uses QuickBooks to track donations for different programs, send tax receipts to donors, and report on grant spending for annual audits.

Professional Services: Project Profitability, Retainer Billing, Time Tracking

QuickBooks helps service-based businesses manage projects, bill clients, and track time.

- Project Profitability: Assign income and expenses to specific projects or clients. QuickBooks shows which projects are most profitable, helping you focus on what works.

- Retainer Billing: Set up recurring invoices for clients on retainer, track hours worked, and apply them against the retainer balance.

- Time Tracking: Employees and contractors can log hours directly in QuickBooks or through integrated apps. Billable hours flow straight into invoices, reducing missed revenue.

QuickBooks tailors its features to fit the real-world needs of each industry, helping businesses stay organized, compliant, and profitable—no matter what field they’re in.

Tips to Boost Your QuickBooks Efficiency

- Recurring Transactions: Automate regular bills and payments.

- Bank Rules: Set up rules to auto-categorize expenses (e.g., all Uber rides as “Travel”).

- Keyboard Shortcuts: Save time with built-in shortcuts (Ctrl+I for invoice, Ctrl+W for write check).

- Batch Invoicing: Send multiple invoices at once to save hours.

- Custom Reports: Build reports that show only what matters to you.

Efficiency Hack: Use the mobile app to snap receipts as soon as you get them—no more lost paperwork.

QuickBooks Software FAQs

QuickBooks Desktop works offline and does not require an internet connection for most features. QuickBooks Online, however, needs an internet connection to access your data and use its full range of tools.

Yes, you can use QuickBooks for multiple businesses, but each business requires its own separate company file or subscription. This keeps financial records and reports distinct for each business entity.

Yes, QuickBooks uses advanced security measures, including 256-bit encryption and multi-factor authentication to protect your financial data. Regular security updates and secure cloud storage help keep your information safe from unauthorized access.

Yes, you can switch from QuickBooks Desktop to QuickBooks Online using the built-in migration tool. This tool transfers your company data, including customers, vendors, and transactions to the online platform for continued access and management.

QuickBooks is designed for a wide range of businesses, including retail, construction, nonprofits, and professional services. Its flexible features support inventory tracking, job costing, fund management, and project profitability, making it suitable for both product-based and service-based companies.

QuickBooks helps businesses stay compliant by automating tax calculations, generating required financial reports, and supporting payroll tax filings. It also provides tools for tracking donations, grants, and contractor payments to meet industry-specific regulations.

Yes, QuickBooks allows you to customize your chart of accounts, invoice templates, and reporting dashboards. You can also add industry-specific features and connect with over 750 third-party apps to tailor the software to your workflow.

QuickBooks offers multiple support options, including live chat, phone support, a comprehensive help center, and community forums. Users can also access video tutorials and step-by-step guides directly within the software.

QuickBooks Online receives regular updates throughout the year, adding new features and improving security. QuickBooks Desktop typically updates annually, with new versions released each year that include feature enhancements and compliance updates.

Final Verdict

Ready to take control of your business finances? QuickBooks gives you the tools to track every dollar, simplify your daily tasks, and make smarter decisions—no accounting degree required.

Start by setting up the basics, explore the features that fit your industry, and connect the apps that save you the most time.

The sooner you get organized, the sooner you can focus on what matters most: running and growing your business. In brief, if you are looking for reliable accounting software, then QuickBooks is a solid choice.